1. Programme Background

Malawi Value Chains (MVC), implemented by Adam Smith International (ASI), is one of three components of the Malawi Trade and Investment Programme (MTIP), a five-year FCDO-funded initiative that aims to break Malawi’s cycle of low growth by driving exports. The overall objective is to increase productivity, quality production, and export performance of the macadamia and mango value chains, as well as supporting increased mining investment and, ultimately, exports. Another complementary MTIP component focuses on reducing the time and costs of trade and logistics, implemented by TradeMark Africa.

2. Objective

The Government of Malawi has identified the mining sector as a key pillar of its economic growth and development strategy, driven by the potential for increased mineral production and the anticipated progression of new medium- and large-scale mining projects toward final investment.

The Malawi Stock Exchange (MSE) is undertaking a comprehensive review of its capital markets framework, with the purpose of making it suitable for the imminent listings of mining companies. The review will align with international good practices, enhance market efficiency and support sustainable economic development.

MVC is supporting this engagement and is seeking to engage a Capital Markets Specialist toprovide technical assistance inreviewing and, where necessary,updating the legal, regulatory and operational framework for effective listing of mining companies.

The primary objective of the consultancy is to support the Malawi Stock Exchange in updating and expanding its capital markets framework for mining company listings. The consultant will assess current relevant frameworks, identify gaps, and recommend improvements and additions across policy, regulatory and operational areas.

3. Scope of Work

The Capital Markets Specialist will be responsible for the following tasks:

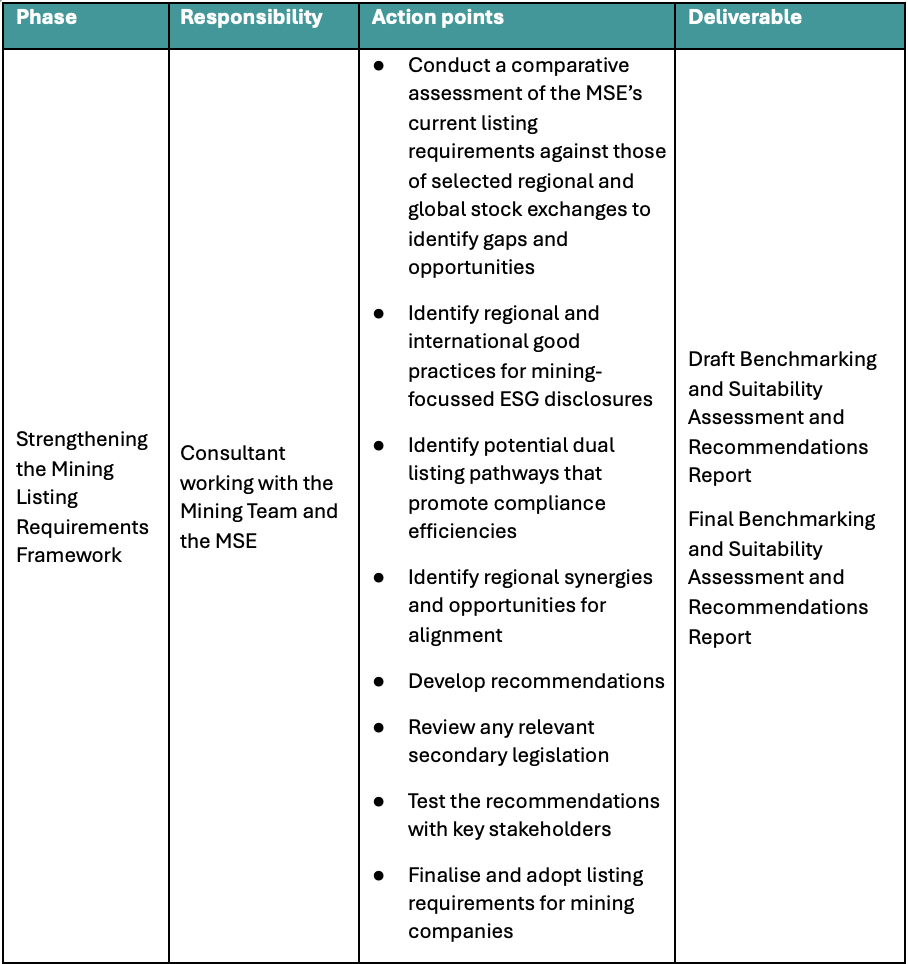

Strengthening the Mining Listing Requirements Framework

To facilitate the smooth and successful listing of mining companies on the MSE, the existing listing requirements framework should be reviewed through a suitability assessment and a detailed benchmarking exercise against both international and regional listing requirements. Special attention will be given to ESG considerations and dual listing pathways.

Conduct a comparative assessment of the MSE’s current listing requirements against those of selected regional and global stock exchanges to identify gaps and opportunities. The analysis should cover both general (industry-agnostic) listing requirements and those specific to the mining sector. This assessment will involve consultations with key stakeholders, including the Reserve Bank of Malawi, the Chamber of Mines, MCCCI, relevant mining companies, and any other identified parties.

Identify regional and international good practices for mining-focussed ESG disclosures, and assess which disclosures are most appropriate and feasible for adoption within the Malawi context.

Identify potential dual listing pathways that promote compliance efficiencies. Companies expected to pursue dual listings on the MSE and other exchanges such as the Australian Securities Exchange (ASX) and London Stock Exchange (LSE) are likely already complying with specific international disclosure principles or methodologies. The consultant will assess the applicability and impact of aligning MSE requirements with commonly applied international standards or methodologies, including those of ASX and LSE, to streamline compliance processes and attract cross-border issuers.

Identify regional synergies and opportunities for alignment (mining framework only). Work with ongoing efforts to foster integration among SADC stock exchanges, identifying how listing requirements could be best shaped to allow regional stock exchanges to speak to one another, creating multiple listing opportunities.

Develop recommendations. Create a list of proposed amendments and additions to the current mining framework.

Review any relevant secondary legislation to ensure alignment with recommendations and address any potential challenges.

Test the recommendations to the current framework with investor groups and mining companies. This may include the development of a consultation paper to invite structured feedback from stakeholders.

Finalise and adopt listing requirements for mining companies. Provide recommendations for adoption by MSE and its shareholders.

Support for Listing Preparation and Mining Company Engagement

Once the amended framework is adopted, the MSE will need to publicly announce the changes to the listing requirements to ensure all market participants are informed and able to respond appropriately. The MSE will also work closely with mining companies preparing to list, supporting a smooth and successful listing process. In parallel, this phase will strengthen the MSE’s capacity to engage with mining companies and other key stakeholders, effectively communicating the value proposition of listing.

Update any Listing Rulebook and/or Guidance Notes (Mining Guidance Note).

Institutional strengthening opportunities to equip the MSE to engage and guide mining companies and other key sector players on the value proposition of listing and for future listings. Provide real time technical backstopping to the MSE through listing of first mining companies to come to the bourse.This could also include supporting learning engagements with other stock exchanges, for example the LSE or ASX, trainings and the development of tools and templates.

Industry Readiness – Marketing New Investment Opportunities

This area of support focuses on promoting new investment opportunities to both attract investors and assist companies in raising capital. Key activities include marketing upcoming listings, conducting investor education campaigns, boosting investor confidence, increasing market visibility, and strengthening the capacity of intermediaries and ecosystem participants to support new listings and financial instruments.

Support the organisation and content development of a mining investor webinar, allowing companies to pitch directly to analysts, fund managers and other investors. This will help to spotlight new opportunities.

Capacity building activities and training for intermediaries and other key players to support new listings.

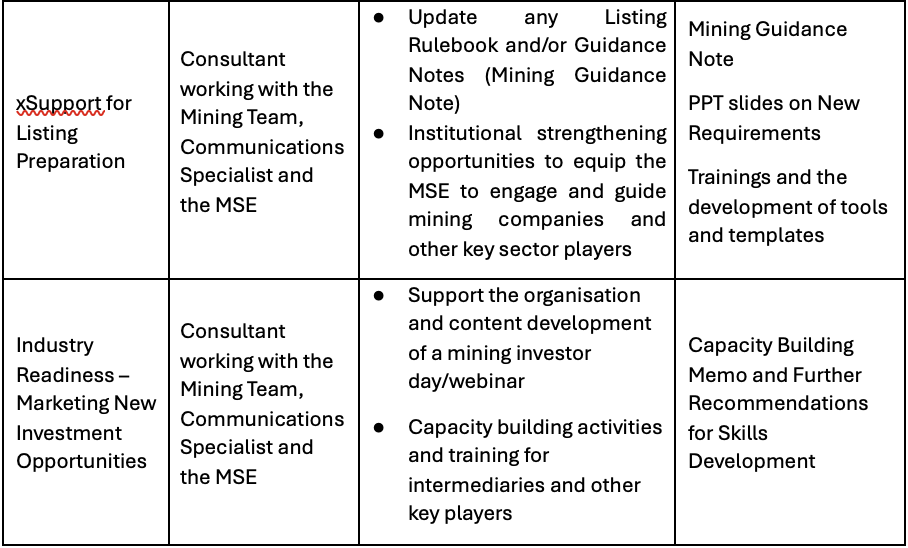

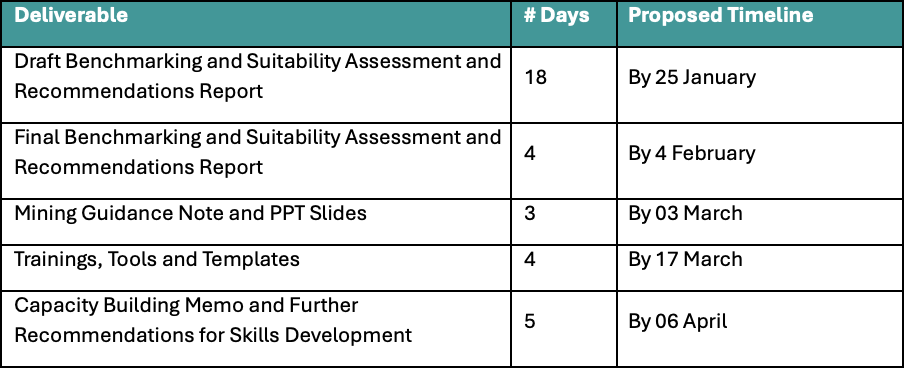

4. Activities and Deliverables

Key activities and deliverables are listed below:

5. Timing and Duration

The engagement is expected to take 5 months, with clear milestones to be defined in the inception report.

Requirements

Eligibility Criteria

This study requires expertise in the following areas:

Demonstrated expertise in capital markets, with a focus on regulation, listing rules and issuer disclosure in the extractive industries.

Strong familiarity with international standards, and experience applying them in diverse market contexts.

Experience working with or advising stock exchanges, securities regulators, or multilateral financial institutions.

Legal, regulatory drafting and policy development skills.

Strong stakeholder engagement skills and ability to communicate technical findings clearly.

Familiarity with Malawi’s mining sector and political economy (strongly preferred).

Minimum of a master’s degree in law, finance, economics or a related field, or equivalent professional experience.

Deadline for applications is December 14th 2025.

Highlights

Ready to Apply?

Submit your CV and a brief cover letter detailing your fit for the role and ability to deliver the assignment.